In LAB 50 version 7, changing the VAT rate requires changes in the Store Management section of the software.

The steps are the following:To add a VAT:

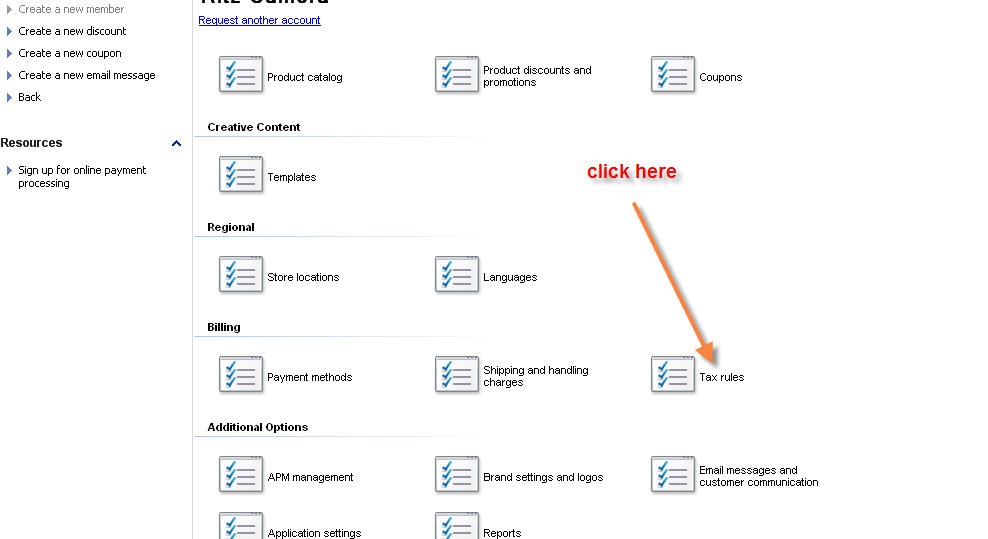

1. Click on the Store Management tab on the top tab fields . (see image below)

| Wiki Markup |

|---|

{table-plus:align=center}

|!mainpage.jpg|thumbnail,border=1!|

{table-plus} |

2. Click on the Tax Rule section. (see image below)

| Wiki Markup |

|---|

{table-plus:align=center}

|!taxrulepage.jpg|thumbnail,border=1!|

{table-plus} |

then Tax Rules

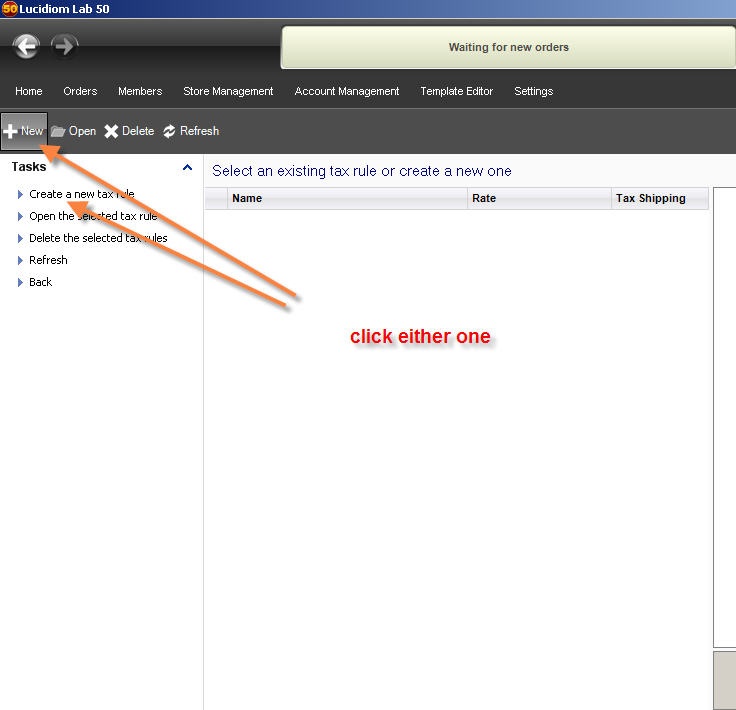

23. If you don’t have an existing Tax Rule, simply click on New or Create a new Tax Rule. If there’s an existing rule, double-click on this specific Tax Rule. ( see image below)

| Wiki Markup |

|---|

{table-plus:align=center}

|!makingtaxrulepage.jpg|thumbnail,border=1!|

{table-plus} |

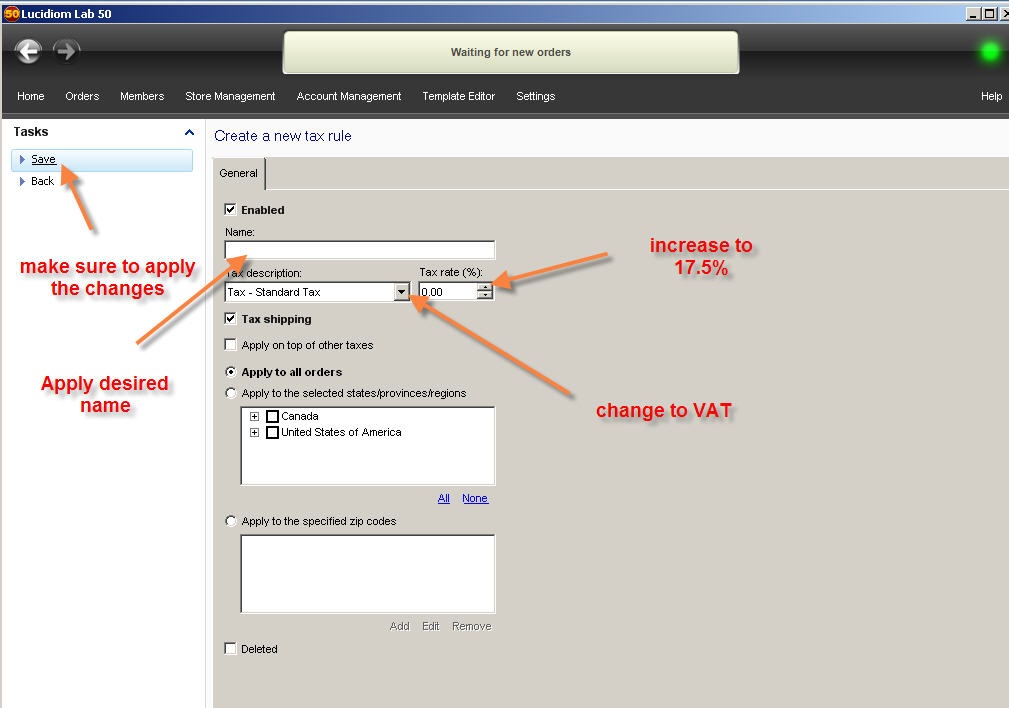

34. Once, the tax rule section open, please make sure you pick the VAT field in order to perform the change. (see image below)

| Wiki Markup |

|---|

{table-plus:align=center}

|!adjustmenttaxpage.jpg|thumbnail,border=1!|

{table-plus} |

Make sure you press Save to retain the changes

5. Make sure you press Save to retain the changes in LAB50.